The New York Stock Exchange (NYSE), a symbol of capitalism's energy and complexity, is a powerhouse that facilitates the exchange of around $2.3 trillion worth of securities daily. This bustling marketplace, where fortunes are made and lost, represents more than just a platform for buying and selling stocks. It stands as a testament to human ingenuity and a focal point of economic activity. However, behind the iconic façade and the frantic trading floor lies a sophisticated, well-orchestrated system. This guide aims to unravel the intricate workings of the NYSE, presenting an in-depth understanding of its structure, operations, and the critical role it plays in global finance.

History of the New York Stock Exchange

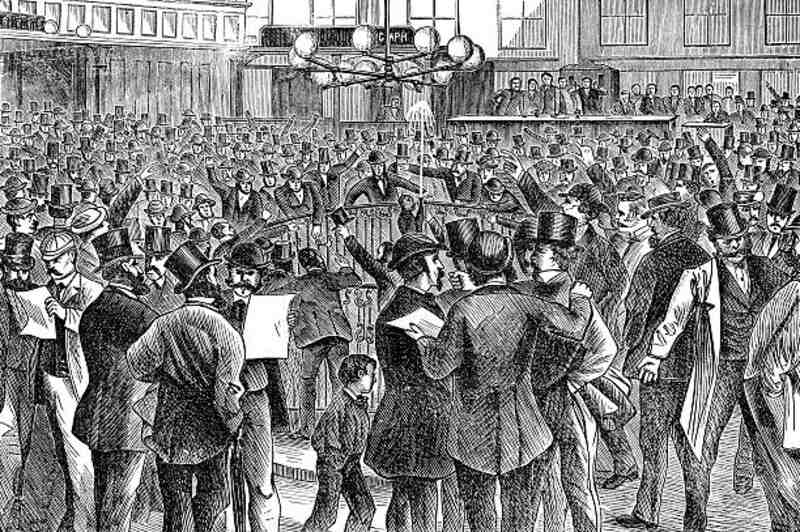

The NYSE has a rich and storied history, dating back to 1792 when the institution was established under a buttonwood tree at Wall Street in lower Manhattan. The first recorded transaction on the exchange was for 24 shares of Bank of New York stock, setting the precedent for future trading activities.

Over the years, the NYSE evolved and expanded, adapting to changes in the financial landscape and technological advancements. In 1817, it officially became known as the New York Stock & Exchange Board, later changing its name to the New York Stock Exchange in 1863. The iconic building on Wall Street, where trading still takes place today, was constructed in 1903.

Importance and global influence of the NYSE

The NYSE has become synonymous with the American financial system, representing a cornerstone of the global economy. As the largest stock exchange in the world by market capitalization, it sets the benchmark for other exchanges and serves as a significant indicator of economic health.

Moreover, many multinational corporations, including some of the biggest names in technology like Apple and Microsoft, have their stocks listed on the NYSE. This global reach and influence make the exchange a critical player in the international financial landscape.

Structure of the New York Stock Exchange

The NYSE has a complex structure that involves several parties, each with specific roles and responsibilities. These include listed companies, traders, brokers, market makers, specialists, and regulators.

Listed Companies

Listed companies are those that have gone through the rigorous process of meeting the NYSE's listing requirements and are approved to be traded on the exchange. These companies must adhere to strict reporting standards and regulations, providing transparency and accountability to shareholders.

Traders

Traders are individuals or institutions that buy and sell securities on the exchange. They can be either investors looking for long-term investment opportunities or traders seeking short-term gains.

Brokers

Brokers act as intermediaries between buyers and sellers, executing trades on behalf of their clients. They are responsible for finding the best price possible for their clients' orders and facilitating the trade process.

Market Makers

Market makers play a crucial role in maintaining liquidity in the market by constantly buying and selling securities. They help ensure that there is always a buyer or seller for any given security, providing stability to the market.

Specialists

Specialists are NYSE employees who oversee specific stocks and ensure fair and orderly trading. They are responsible for matching buyers and sellers' orders, maintaining an orderly market, and setting opening and closing prices for their assigned securities.

Regulators

Regulators, including the Securities and Exchange Commission (SEC), play a critical role in overseeing the NYSE's operations. They ensure that all parties involved follow regulations and maintain market integrity.

Trading on the New York Stock Exchange

Trading on the NYSE is a well-orchestrated process that involves multiple steps, from submitting an order to executing the trade. Here is a simplified breakdown of how trading occurs on the exchange:

- Submit an Order: A trader submits an order to buy or sell a specific security through their broker.

- Broker forwards the order: The broker then sends the order to the floor of the NYSE, either electronically or through a designated employee known as a floor broker.

- Specialist matches orders: Once received, specialists match buyers and sellers' orders and determine the best price at which to execute the trade.

- Trade executed: The specialist executes the trade by filling the buy or sell order, and the details of the trade are recorded in a central system.

- Confirmation sent: Once the trade is complete, a confirmation is sent back to both parties involved in the transaction.

- Settlement occurs: The final step in the trading process is settlement, where the actual exchange of money and securities takes place.

How Stocks are Listed?

Getting listed on the NYSE is a coveted achievement for companies, as it provides access to a wide pool of investors and boosts their credibility. However, not all companies can meet the stringent listing requirements set by the exchange.

To be eligible for listing, a company must have at least 400 shareholders, with its stock price trading at a minimum of $4 per share. It must also have a market capitalization of at least $100 million, among other requirements.

The listing process involves submitting an application to the NYSE and undergoing a thorough review by the exchange's staff. Once approved, the company's stocks are listed on the exchange and begin trading publicly.

Impact of the NYSE on the Economy

The NYSE's influence goes beyond just being a platform for buying and selling stocks. It plays a crucial role in driving economic growth and stability by providing companies with access to capital, creating jobs, and generating wealth.

Moreover, the daily fluctuations of stock prices on the exchange can impact consumer confidence, which affects spending patterns and overall economic health. The NYSE is also closely monitored by economists and policymakers, making it a critical indicator of the economy's performance.

Conclusion

The New York Stock Exchange has a rich history and global influence, serving as the backbone of the American financial system. Its complex structure, trading process, and impact on the economy make it an essential institution in today's modern world. As technology continues to advance, the NYSE remains at the forefront of innovation in the financial industry, adapting to changing times while maintaining its status as the world's leading stock exchange. So, it can be concluded that the NYSE will continue to play a vital role in shaping the global economy for years to come.